Gold_holdings

Gold holdings

Quantities of gold held as a store of value

Gold holdings are the quantities of gold held by individuals, private corporations, or public entities as a store of value, an investment vehicle, or perceived as protection against hyperinflation and against financial and/or political upheavals.[citation needed]

This article needs additional citations for verification. (October 2017) |

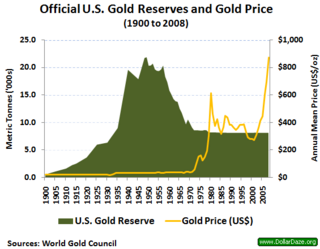

During the 19th and early 20th Century eras of the gold standard, national governments undertook an obligation to redeem the national currency for a certain amount of gold.[1] In such times, the nation's central bank used its reserves to meet that obligation, backing some or all of the currency in issue with the metal it held.[2]

The World Gold Council estimates that all the gold ever mined, and that is accounted for, totals 187,200 tonnes, as of 2017[3] but other independent estimates vary by as much as 20%.[4] At a price of US$1,250 per troy ounce, marked on 16 August 2017, one tonne of gold has a value of approximately US$40.2 million. The total value of all gold ever mined, and that is accounted for, would exceed US$7.5 trillion at that valuation, using WGC's 2017 estimates.[lower-alpha 1]