New_Zealand_property_bubble

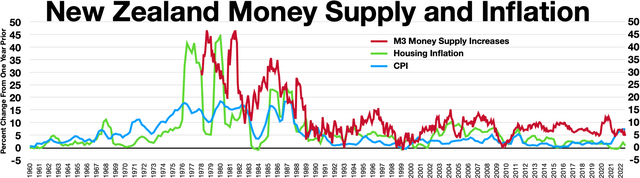

The property bubble in New Zealand is a major national economic and social issue. Since the early 1990s, house prices in New Zealand have risen considerably faster than incomes,[1] putting increasing pressure on public housing providers as fewer households have access to housing on the private market. The property bubble has produced significant impacts on inequality in New Zealand, which now has one of the highest homelessness rate in the OECD[2] and a record-high waiting list for public housing.[clarification needed][3] Government policies have attempted to address the crisis since 2013, but have produced limited impacts to reduce prices or increase the supply of affordable housing. However, prices started falling in 2022 in response to tightening of mortgage availability and supply increasing. Some areas saw drops as high as around 9% - albeit from very high prices.

A house price bubble is defined by economist Joseph Stiglitz as a period of speculative purchases, where investors demonstrate willingness to pay a high price today because they believe that it will be as high (or higher) tomorrow.[4] A 2016 study found evidence of a bubble in the New Zealand housing market from 2003, which stalled in 2007/8 with the impacts of the global financial crisis.[citation needed] A second bubble appeared in Auckland in 2013, and until 2015 there were no notable spillover effects to other regions.[5] However, from 2015 onwards, rapid price-growth occurred in smaller centres.[citation needed]

Housing in New Zealand has been strongly shaped by colonisation (beginning in the 19th century), pre-war state intervention, post-war state intervention and economic and financial reforms introduced since the 1980s. Although the indigenous Māori population traditionally lived communally, European settlers – many fleeing the slum conditions of Victorian Britain – established a trend favoring individually-owned houses, each built on a separate section of land – the fabled quarter acre, in a similar vein to the American white picket fence.[6] New Zealand society as a whole continues to dream the dream of owner-occupied home-ownership despite changing economic and environmental conditions. The local real-estate sector promotes myths of moving onto (and up) the property ladder[7] accordingly, and New Zealand politicians foster the idea of a stable democracy rooted in property-ownership.[8][9][10]

In 1977, the Town and Planning Act was passed, which began to make it easier for NIMBYs to oppose new housing nearby and force down-zoning. This caused house prices to rise by an average of 2% for every 1% increase in population between 1977-2018, compared with 0.5% rise per 1% population increase between 1938-1977.[11]

The fourth Labour Government (elected in 1984) rapidly introduced policies of economic deregulation,[12] as a result of the previous Prime Minister Robert Muldoon's Think Big policies that had left the country heavily in debt.[13] Investment in shares increased rapidly, often with little due diligence carried out.[14][15] The 1987 sharemarket crash hit New Zealand's economy especially hard,[16] with the NZSE dropping around 60% from its peak.[17][18] Many investors who lost heavily in the 1987 crash never returned to the sharemarket, instead opting for the apparently safer option of property investment.[19][20][16][15]

In 1989 Parliament passed the Reserve Bank Act, which emphasised keeping a lid on inflation and on interest rates, which in turn reduced the costs of borrowing for fixed assets such as houses. In the same year, tax exemptions for pension, insurance and other similar investments were abolished, but not for real estate. Two years later, the Resource Management Act (RMA) replaced a raft of regional-planning laws, including the Town and Planning Act. Some[who?] have regarded the RMA as an obstacle to building affordable housing.[21] Although builds and sell-offs of state houses have happened in cycles since the inception of the state housing scheme, they were sold off in record numbers during the 1990s without being replaced.[22][23] The number of state houses in the country peaked at 70,000 in 1991 until the sell-offs.[24]

Alongside institutional reforms in the housing sector, problems with poor-quality construction, historic injustices and under-provision for the needs of indigenous Māori,[25] and persistent income inequality,[26] the lack of affordable housing is a critical issue. Since the global financial crisis, the rapid growth in house prices has spawned an affordable housing crisis[citation needed] and housing has been a prominent issue on political agendas since 2013.[citation needed] Despite a number of policy interventions to address the crisis, prices have continued to grow across the country. As shown below, real house-prices increased almost three-fold between 2000 and 2018.[27]

Graphs are unavailable due to technical issues. There is more info on Phabricator and on MediaWiki.org. |

While house prices increased almost-continuously from the early 1990s, it was not until 2007 that the media started reporting an affordability crisis.[28] Nationwide, property prices increased 80% in real terms between 2002 and 2008.[29] The Global Financial Crisis caused a 10% drop in nominal prices in 2008, however price growth picked up again significantly following the crisis and by 2014, nominal prices in Auckland were 34% higher than the pre-crisis peak.[30]

As of 2019, the average house price in New Zealand exceeded NZ$700,000, with average prices in the country's largest city, Auckland, exceeding $1,000,000 in numerous suburbs.[31] The ratio between median house price and median annual household income increased from just over 3.0 in January 2002 to 6.27 in March 2017, with Auckland's figures 4.0 to 9.81 respectively.[32][33]

As of 2021, the average house price in New Zealand exceeded $1,000,000[34]

In 2017, the Demographia think-tank ranked Auckland's housing market the fourth-most unaffordable in the world—behind Hong Kong, Sydney and Vancouver—with median house prices rising from 6.4 times the median income in 2008 to 10 times in 2017.[35] Another study carried out in 2016 reported that average house prices in Auckland surpassed those of Sydney.[36] That same year, the International Monetary Fund ranked New Zealand at the top for housing unaffordability in the OECD,[37] and has called for taxation of property speculation.[38]

Multiple property owners in New Zealand are not subject to capital gains taxes and can use negative gearing on their properties, making it an attractive investment option.[39][40] Prospective house-buyers, however, accuse property investors of crowding them out.[41] When the Tax Working Group reported its findings to Parliament in 2019, a capital gains tax was among its recommendations, only to be shelved after failing to secure enough Parliamentary backing.[42]

According to NZ's 2017 register of pecuniary interests,[43] New Zealand's 120 members of parliament own more than 300 properties between them,[44][45][46] prompting accusations of conflict of interest.[47]

NIMBY sentiment among established home-owners—particularly towards attempts to relax building density rules in Auckland such as the Unitary Plan[48]—has also been pointed to as a major factor in the housing bubble.[49][50][51][52][53][11] In response, a YIMBY movement of mostly younger people has emerged to call for actions against housing unaffordability, including upzoning.[54][55][56][57]

In late 2021, it was reported by property data company Valocity that over 22,100 homes were owned by "mega-landlords" who owned more than 20 properties each, as part of a trend towards further concentration of the housing market by investors.[58]

Regional dynamics

The house price bubble first emerged in Auckland, and subsequently spread to other areas of the country. The figure below shows the regional changes in average house price, between 2014 and 2019.[59]

Social impacts of the affordability crisis

Unaffordable housing has produced profound impacts on New Zealand society. Between 1986 and 2013, home ownership dropped from 74% to 65%.[60]

The most recent statistics on homelessness, from the 2013 Census, showed that 1% of the population were living in severe housing deprivation. Of this population 71% are temporarily resident in severely crowded private dwellings, 19% live in commercial dwellings or marae, and 10% live on the street or in a car.[61] Between 2017 and 2019, the waiting list for public housing doubled, reaching a record 12,500 in August 2019.[62] In 2018, a report found that emergency housing providers were turning away 80–90% of those seeking assistance.[63]

| Year | Eligible families and individuals waiting for public housing |

|---|---|

| Sep-14 | 4,189 |

| Sep-15 | 3,399 |

| Sep-16 | 4,602 |

| Sep-17 | 5,844 |

| Sep-18 | 9,546 |

| Sep-19 | 13,966 |

| Sep-20 | 21,415 |

| Sep-21 | 24,546 |

The substantial growth of property prices over recent decades has significantly influenced the distribution of wealth in New Zealand. The 2019 National Business Review Rich List showed that eight of the top 25 wealthiest people made their money from property, and 16 of the 20 new additions to the list also became wealthy through property investment.[64] Rising prices have been attributed to various factors including deregulation, immigration and politics, with considerable debate over how to address the issue due to its large size relative to the economy.

The Loafers Lodge fire in May 2023, where five people died and 20 were injured, further increased scrutiny on the housing crisis' effects.[65][66]

Policies to address the housing affordability crisis cover land use and planning regulation, state housing provision, rules on ownership and investment, and financial regulation.

National government, 2008–2017

Special Housing Areas

In 2013, the government passed the Housing Accord and Special Housing Areas Act 2013, introducing Special Housing Areas (SHAs) to increase land supply in urban areas. Within designated SHAs, developments larger than 14 dwellings were required to allocate 10% of housing at 'affordable' prices. Affordability was defined as 75% of the region's median house price, or a price at which households earning up to 120% of median household income would spend no more than 30% of gross income on rent or mortgage repayments. Research showed that little evidence for the effectiveness of this policy to improve affordability.[67] The act was not extended beyond 2019, after generating disappointing results.[68]

From 2016, the housing development planned by Fletcher Building on a designated Special Housing Area at Ihumātao was opposed by protesters, who set up a camp at the site. Opponents contended that the land was confiscated during the Waikato War in 1863, in breach of the Treaty of Waitangi. In 2017 the United Nations recommended that the New Zealand Government review the designation of Ihumātao as a Special Housing Area, drawing attention to potential breaches of human rights.[69] In 2019, after protestors were served an eviction notice and police presence escalated, the prime minister announced that no development would take place at Ihumātao while the government attempted to broker a solution.[70]

Bright-line test

In October 2015 the government introduced a bright-line test to reduce speculative investment. This test applies to all property acquired after the law was introduced, and taxes capital gains at the same level as the seller's income tax rate.[71]

Loan-to-value restrictions

The loan-to-value ratio measures how much a bank lends for a property, compared to the property's total value. Loan-to-value (LVR) restrictions were first introduced in 2013 by the Reserve Bank of New Zealand. The restrictions comprised a 'speed limit' on the proportion of high-LVR loans that banks can issue, and a threshold defining high-LVR loans.[72]

Initial LVR restrictions in October 2013 restricted banks to no more than 10% of loans beyond 80% LVR. In 2015, the restrictions were revised to target price inflation in Auckland, easing the restrictions to 15% over 80% LVR for non-Auckland loans, and increasing to 5% over 70% LVR for investor purchases in Auckland. In 2016 the restrictions tightened further on Auckland investors, to 5% over 60% LVR.

Since 2018, LVR restrictions gradually reduced to 20% over 80% for owner-occupiers, and 5% over 70% for investors. In April 2020 the Reserve Bank lifted restrictions on mortgage borrowing in response to the COVID-19 pandemic, to ensure that the LVR rules did not unduly affect lenders or borrowers as part of the mortgage deferral scheme introduced in response to the pandemic.[73]

The Reserve Bank has suggested that the targeted restriction for Auckland properties in 2015 may have contributed to price inflation in other regions.[74]

National Policy Statement on Urban Development capacity (NPS-UDC)

The NPS-UDC is planned to be replaced by the National Policy Statement on Urban Development (NPS-UD), which the government consulted on in 2019.

The purpose of the NPS-UDC, introduced in 2016, was to ensure that sufficient development capacity was provided by local authorities, to meet demand for land for housing and commercial use. The NPS-UDC provided targeted measures for high-growth areas.

Labour-New Zealand First coalition government, 2017–2020

Foreign ownership ban

In August 2018 the New Zealand Parliament passed a law to ban non-resident foreigners from buying existing homes,[75] delivering on a New Zealand First Party's election promise. The law allows non-residents to own up to 60% of units in new-build apartment blocks, however, they are not permitted to buy existing homes. Immigration remained a topic of controversy in regard to housing affordability; the Reserve Bank and others cited immigration as a factor in rising house-prices.[citation needed] Annual net migration as of 2017 was approximately 70,000, compared with an average of 15,000 in the previous 25 years.[76][77] However the Ministry of Business, Innovation and Employment refuted this emphasis, saying that New Zealanders returning from overseas make up much of the inflows, and that there was a need to allow in "skilled migrants required to ramp up housing supply".[78] In 2016 it was reported that Auckland had over 33,000 "ghost" properties that were registered as unoccupied, many of them believed to be owned by absentee foreigners.[79][80]

Extension of bright-line test

The bright-line test introduced under the previous administration was extended to five years, to reduce incentives for speculative investment in property. The five-year rule applies to properties purchased after March 2018, and the main family home is exempt.[81] Changes in legal ownership for a property can count as a disposal, and can "reset the clock" on the five-year limit, even if the property is substantively owned and controlled by the same person.[82]

State housing construction

In December 2017 the Labour-NZ First coalition government stopped the sale of Housing New Zealand properties,[83] and committed to expanding the supply of public housing.

KiwiBuild

KiwiBuild, the flagship housing policy of the New Zealand Labour Party, proposed to deliver 100,000 houses in ten years to address the affordability crisis. The scheme planned to boost housing supply by giving property developers more incentives to deliver affordable homes rapidly. This included the Land for Housing programme, which acquired vacant land, on-selling to developers, with conditions of making 20% of dwellings available for public housing and delivering 40% "affordable" housing according to KiwiBuild criteria. The scheme also purchased properties off-the-plans from developers, to sell to eligible buyers.[84] Construction-sector capacity to deliver KiwiBuild's targets was identified[by whom?] as a challenge, and the government introduced a KiwiBuild Shortage List, allowing accredited construction employers to accelerate the immigration process for construction workers.[85]

Criticism of the policy highlighted that the prices of KiwiBuild homes remained out of reach for many, with "affordable" properties costing upward of NZD$500,000 in Auckland, and NZD$300,000–500,000 across the rest of the country.[86] By September 2019 the scheme had delivered only 258 houses – well below the targets.[87] The uptake also showed that the Kiwibuild homes did not attract buyers, with unsold homes released onto the private market in some regions.[87]

KiwiBuild reset

A "reset" of KiwiBuild was released[by whom?] in 2019, following the reshuffle of ministerial responsibilities for housing and appointment of Dr. Megan Woods as Minister for Housing.[88] The revised policy dropped the target to build 100,000 houses in ten years and introduced rent-to-buy and shared-equity options to improve affordability. The requirement for first-home buyers to hold their Kiwibuild homes for at least three years was reduced to one year.

National Policy Statement on Urban Development (NPS-UD)

The NPS-UD was consulted on[by whom?] in October 2019, to replace and expand on the 2016 NPS-UDC. The NPS-UD has a similar purpose to its predecessor, to enable growth in new areas by removing unnecessary restrictions, targeted to high-growth areas.

The discussion document[89] included a range of requirements for councils, including:

- new objectives for Future Development Strategies, to ensure that growth is coordinated and responsive to demand

- allowing growth through intensification and greenfield development, in a way that contributes to a quality urban environment

- developing and maintaining an evidence base on demand and prices for housing and land

- ensuring the co-ordination of planning across urban areas, taking into account issues of concern for iwi and hapū

The NPS-UD was planned[by whom?] for implementation by mid-2020.

Labour government, 2020–2023

Repeal of the Resource Management Act

In 2020, the Labour Party won a parliamentary majority; in 2021, the new government announced that it planned to repeal the Resource Management Act and to replace it with three separate planning acts:[90][91]

- the Natural and Built Environments Act, focused on land use and environmental regulation

- the Strategic Planning Act, pulling together laws around development

- the Climate Change Adaptation Act, focused on managed retreat and its funding

The law changes were announced by Environment Minister David Parker following a 2020 high-level independent review into the Resource Management Act, which concluded that the Act had failed in its purpose.[92][93] The RMA was finally repealed on 16 August, 2023.[94]

March 2021 reform

As housing affordability worsened throughout February 2021, Jacinda Ardern announced that her government had undertaken a significant review of housing policy:[95][96][97]

- Removal of interest rate tax-deduction.

- Housing Aid cap lifted for first home buyers.

- Allocation of infrastructure funds (named Housing Acceleration Fund) for district councils.

- Extension of the Bright Line Test from five to ten years.

Treasury recommended that the Bright Line Test be extended from five to twenty years, double that than what was eventually implemented. Both Inland Revenue and Treasury urged that the government not abolish the interest rate deduction.[98]

Later in the year, a bipartisan agreement on Medium-Density Residential Standards (MDRS) was drafted and signed by the Labour and National Parties in Parliament to relax urban density rules. The new rules would allow houses up to three storeys to be built in existing areas, without the need for a resource consent.[99] Two years later however, the National Party backed out of the agreement, claiming their own housing policy was "more ambitious and allowed discretion and flexibility for councils.".[100]

Tax reform

Capital gains tax

There is currently no tax on capital gains from property investment in New Zealand. The bright-line test introduced in 2015 and extended in 2018 aims to tax capital gains on property, however the main family home, estates, or properties sold through relationship settlements are exempt.

In late 2017, the Labour Government established the Tax Working Group, an advisory group to examine improvements to the fairness and balance of the tax system. The group published its report in February 2019, recommending a tax on capital gains that applies to gains and most losses related to all types of land and improvements, except for the main family home.[101] This tax would apply to rental and second homes, business assets, land and shares. Following robust public and media debate, the government abandoned their plan to introduce the capital gains tax, citing a lack of consensus within government.[102] The OECD and IMF have issued multiple recommendations for the passage of a capital gains tax.[103][104][105][106]

Land value tax

Land value taxation has been suggested by a series of commentators, including Dr. Arthur Grimes and Dr. Andrew Coleman,[107] Dr. Ryan Greenaway-McGrevy,[108] economist Shamubeel Eaqub and Bernard Hickey.[109]

Land use reform

In September 2015, the New Zealand Productivity Commission released a comprehensive report on Using land for housing, commissioned by the government to review local council processes for providing land for housing, with a focus on fast-growing areas. According to the report, insufficient supply of developable brownfield and greenfield land was a major contributor to house price growth between 2000 and 2015. It proposed reform in a range of areas:

- Lifting restrictive planning controls in areas with spare capacity on existing infrastructure networks

- More effective cost-recovery of infrastructure costs

- Greater use of cost-benefit analysis for land use rules

- Granting local urban development authorities (UDAs) more power to develop housing

- Powers for central government to intervene to ensure sufficient development capacity is released, if councils are unable to release land (this was implemented through the 2016 National Policy Statement on Urban Development Capacity).

Financial regulation

Debt-to-income limits

In 2017 the Reserve Bank of New Zealand published a consultation paper on debt-to-income limits, as a tool to restrict credit growth and mitigate the risk of mortgage defaults during an economic downturn. High levels of private debt present a significant macro-economic risk. It reduces household consumption by diverting a large proportion of income to servicing debts and also makes households vulnerable to economic shocks.[110]

According to investment manager Brian Gaynor in 2012, a 10% drop in house prices would wipe out $60 billion of New Zealanders' personal wealth, which would exceed the losses from the 1987 sharemarket crash.[14] Steve Keen, one of the few economists to forecast the Great Recession, warned in mid-2017 that New Zealand would be one of many nations to experience a private debt meltdown involving housing, and that "the bubble will burst in the next one to two years".[111] A report published by Goldman Sachs predicted that New Zealand had a 40% chance of a "housing bust" over the same period.[112] Financial commentator Bernard Hickey described New Zealand's property market in 2014 as "too big to fail", and supports a deposit insurance scheme in the event of a banking collapse caused by a property crash.[113] Later, in 2021, Hickey described New Zealand's economy as "a housing market with bits tacked on".[114]

The Reserve Bank of New Zealand has estimated that the total value of housing loans has increased from just under $60 billion in 1999 to over $220 billion in 2016.[115]

In April 2021 the total value of housing loans was estimated to be $307.9 billion, having grown by over $30 billion in the preceding 12 month period.[116]

- Housing in New Zealand

- KiwiBuild

- Real estate bubble

- Taxation in New Zealand

- New Zealand dream – aspirations of owning a property

- The Property Cycle

- Bernard Hickey (17 August 2009). "Opinion: Why the golden oldies are wrong: housing is less affordable now than in 1987 and 1975 (Corrected)". interest.co.nz.

- Barrett, Jonathan (20 May 2018). "Left behind: why boomtown New Zealand has a homelessness crisis". Reuters.

- Cooke, Henry (20 August 2019). "Public housing waitlist at new high with 12,644 households waiting months for housing". Stuff.

- Stiglitz, J.E. (1990). “Symposium on bubbles”. In: Journal of Economic Perspectives Vol. 4 No. 2, pp. 13–18

- Greenaway-McGrevy, R. (2015). "Hot property in New Zealand: Empirical evidence of housing bubbles in the metropolitan centres". New Zealand Economic Papers. 50 (1): 88–113. doi:10.1080/00779954.2015.1065903. hdl:2292/25259. S2CID 16641463.

Evidence from the latest data reveals that the greater Auckland metropolitan area is currently experiencing a new property bubble that began in 2013. But there is no evidence yet of any contagion effect of this bubble on the other centres, in contrast to the earlier bubble over 2003–2008 for which there is evidence of transmission of the housing bubble from Auckland to the other centres.

- John Burn-Murdoch (17 March 2023). "The Anglosphere needs to learn to love apartment living". Financial Times.

- "REINZ Welcomes National's Announcement To Repeal 90-day No Cause Evictions". World News LLC. Scoop Media. 10 May 2020. Retrieved 24 March 2021.

The Real Estate Institute of New Zealand (REINZ) has today welcomed National's housing policy announcement [...] Bindi Norwell, Chief Executive at REINZ says: '[...] In terms of social housing tenants being able to buy their own state house, this is a great initiative and will hopefully allow a number of people to be able to get a foot on the property ladder for the first time [...]'.

- For example: "Build Like the Boomers". ACT Party. ACT New Zealand. Retrieved 24 March 2021.

Safe, secure, and affordable housing provides a platform for a stable family. Homeownership gives everyone a stake in society.

- Compare: "Labour's 2020 campaign policies: Housing". NZ Labour Party. New Zealand Labour Party. Retrieved 24 March 2021.

Labour will continue rolling out a Progressive Home Ownership scheme that will support lower income families struggling to pull together a deposit, or pay a mortgage, into home ownership.

- Compare: "Housing, Infrastructure & World Class Cities". New Zealand National Party. 2020. Retrieved 24 March 2021.

The massive recent house price increases are further locking our children out from ever buying a home. [...] The housing emergency is driving up inequality, and it is hitting young New Zealanders the hardest. We are already seeing a major increase in the working poor here in New Zealand, where people put in the hard yards but still can't get ahead. These house price increases just make it worse.

- Dileepa Fonseka (5 April 2022). "Infrastructure Commission: Politicians and Nimbys created the housing crisis". Stuff.

- "Government and market liberalisation". Te Ara Encyclopedia of NZ.

- Hembry, Owen (31 January 2011). "In the shadow of Think Big". Archived from the original on 10 January 2014.

- Gaynor, Brian (20 October 2012). "Property fallout would top '87 share crash". New Zealand Herald.

- Nadine Higgins (7 September 2017). "Eyewitness: Black Monday". Radio New Zealand.

- Liam Dann (12 October 2017). "The Crash". New Zealand Herald.

In October 1987 a stock market crash shook the world. Nowhere was hit harder than New Zealand.

- "Share Price Index, 1987–1998". Archived from the original on 25 May 2010.

- "Commercial Framework: Stock exchange, New Zealand Official Yearbook 2000". Statistics New Zealand. Archived from the original on 4 March 2016. Retrieved 8 December 2014.

- Tony Field (3 August 2016). "Shares outperform property, but not popular investment choice". Newshub.

Mr Beale says Kiwis naturally don't like investing, and are very focussed on property, with memories of the 1987 crash still lingering.

'It seems New Zealand is still not investing in the share market because of what happened in the 1987 sharemarket crash.' - "The touch factor". New Zealand Herald. 15 February 2005.

The allure of property investment is quite multifaceted. To some it is the touchy, feely factor. They can buy a property, drive past it and touch it, which is something they can't do with shares and bonds.[...] Others have had bad experiences with shares (think the 1987 sharemarket crash, investors who got burnt haven't forgotten) and other savings schemes and are looking for alternative forms of investment.

- Bernard Hickey (19 April 2017). "1989 was year zero for Generation Rent". Newsroom.co.nz.

As the Productivity Commission and the current government has pointed out repeatedly in recent years, the RMA ushered in an era where councils and residents were more reluctant to open up land for housing, partly because it was easier to object to new developments, and partly because the funding arrangements for councils made it more difficult.

The end result was New Zealand's house building rate dropped from around nine homes per 1,000 people per year during the 1950s, 1960s and 1970s to around five homes per 1,000 people through the 1990s and 2000s. The potential for extra housing supply to both respond to higher house prices and then soften the growth was ripped out by the effects of the RMA and council funding mechanisms. - "Total state housing stock". Te Ara - Encyclopedia of New Zealand.

- "History of State Housing". Kāinga Ora – Homes and Communities.

- Shamubeel Eaqub (25 May 2016). "Is NZ facing a crisis of conscience?". RNZ.

- "Part 2: Māori housing needs and history, and current government programmes". Office of the Auditor-General New Zealand. Retrieved 1 November 2019.

- "The truth about inequality in New Zealand". Stuff. 17 January 2017. Retrieved 1 November 2019.

The wealthiest 20 per cent of households in New Zealand hold 70 per cent of the wealth, while the top 10 per cent hold half the wealth.

- OECD Economic Surveys: New Zealand 2019

- "Your views: How to afford a house in New Zealand". New Zealand Herald. 22 January 2007.

- House Prices Unit (2008) Final Report of the House Prices Unit: House Price Increases and Housing In New Zealand. Wellington: Department of the Prime Minister and Cabinet.

- Murphy, L. (2015). "The politics of land supply and affordable housing: Auckland's Housing Accord and Special Housing Areas". Urban Studies. 53 (12): 2530–2547. doi:10.1177/0042098015594574. S2CID 153777950.

- Fyers, Andy (4 December 2016). "Blowing Bubbles: Where the housing bubble has blown up the biggest". Stuff.co.nz/Business Day.

- David Chaston (11 September 2009). "Median Multiples – House price-to-income multiple". interest.co.nz.

- "New Zealand average house price tops $700k for first time". RNZ. 7 January 2020. Retrieved 12 January 2020.

- "QV House Price Index". www.qv.co.nz. Retrieved 13 November 2021.

- Patrick O'Meara (23 January 2017). "Housing in many NZ cities 'severely unaffordable'". RNZ.

- Andrew Laxon (25 September 2016). "Home truths: City of expensive sales tops Sydney". New Zealand Herald.

- Dan Satherley (1 September 2016). "No fix for housing crisis until young and renters vote – economist". Newshub.

- Hamish Rutherford (9 May 2017). "IMF says housing bubble could unsettle strong New Zealand economy". Stuff.co.nz.

- Simmons, Geoff (17 June 2016). "Why a capital gains tax won't stop the housing bubble". National Business Review.

- Small, Vernon (14 May 2017). "Labour to shut down 'negative gearing' tax break in crackdown on property investors". Sunday Star Times.

- "Are investors crowding first-home buyers out of the market?". New Zealand Herald. 26 April 2016.

- "'No mandate' for capital gains tax – PM". Radio New Zealand. 17 April 2019. Retrieved 17 April 2019.

- Sir Maarten Wevers (31 January 2017). "Register of Pecuniary and Other Specified Interests of Members of Parliament: Summary of annual returns as at 31 January 2017" (PDF). New Zealand Parliament.

- Nicholas Jones and Isaac Davison (9 May 2017). "MPs' latest home ownership, interests revealed". New Zealand Herald.

- Stacey Kirk and Andy Fyers (10 May 2017). "The many houses of our MPs – which MPs have a stake in multiple properties?". Stuff.co.nz.

- "Government MPs' property ownership revealed". RNZ News. 10 May 2017.

- "MPs' housing investments 'no conflict'". RNZ News. 11 May 2015.

- "Auckland Unitary Plan". Auckland Council. 15 November 2016.

- "Group considers legal challenge to Unitary Plan". RNZ News. 28 July 2016.

- Maria Slade (25 February 2016). "Great dollops of nimbyism lock first home buyers out of Auckland upzoning debate". Auckland Now.

- Geoff Simmons (29 July 2016). "Unitary Plan: Inevitable NIMBY backlash begins". National Business Review.

- Rob Stock (22 April 2018). "Housing NZ complex shows Auckland's 'Nimby nightmare' unitary plan in action". Stuff.co.nz.

- Dileepa Fonseka and Joel Maxwell (21 August 2019). "Hopes anti-NIMBY announcement will help 'awful' process of building more houses in Wellington". Stuff.co.nz.

- Scott Palmer & Melissa Tapper (7 June 2021). "Meet the young YIMBYS fighting for Auckland's affordable housing future". Newshub.

- Dileepa Fonseka (26 June 2021). "The Yimbys just flexed their muscles on density, and did not lose". Stuff.

- Ethan Te Ora (22 September 2021). "Life in a 'vertical neighbourhood' — the housing young buyers covet". Stuff.

- Hamish Fletcher (21 January 2018). "Hamish Fletcher: I'm a Yimby and proud". New Zealand Herald.

- Geraden Cann (28 November 2021). "Mega Landlords: Over 22,100 homes owned by small group of very large investors". Stuff.

- "Residential House Values". www.qv.co.nz. Archived from the original on 21 April 2020. Retrieved 11 January 2020.

- Statistics New Zealand (2015). Dwelling and tenure type tables for Auckland from 2013 Census.

- Otago, University of. "3 June 2016, Homelessness accelerates between censuses". University of Otago. Retrieved 1 November 2019.

- "Public housing waitlist at new high with 12,644 households waiting months for housing". Stuff. 30 August 2019. Retrieved 1 November 2019.

- Cheng, Derek (11 February 2018). "Homeless crisis: 80 per cent to 90 per cent of homeless people turned away from emergency housing". The New Zealand Herald. ISSN 1170-0777. Retrieved 1 November 2019.

- Owen Poland (15 August 2019). "NBR Rich List 2019: Why property is still king". National Business Review.

- Emily Clark (18 May 2023). "Loafers Lodge residents reveal poor conditions inside Wellington hostel, as police pursue arson investigation". ABC News.

- Tom Kitchin (25 May 2023). "Loafers Lodge and the lessons for higher density housing". RNZ News.

- "Government will not extend special housing areas law beyond September". Stuff. 12 March 2019. Retrieved 1 November 2019.

- "Ihumātao: NZ breaching human rights obligations – The University of Auckland". www.auckland.ac.nz. Retrieved 1 November 2019.

- "PM blocks building at Ihumatao". Otago Daily Times Online News. 26 July 2019. Retrieved 1 November 2019.

- "Govt to tighten tax on capital gains". RNZ. 17 May 2015. Retrieved 1 November 2019.

- "Loan-to-value ratio restrictions FAQs – Reserve Bank of New Zealand". www.rbnz.govt.nz. Retrieved 1 November 2019.

- "Reserve Bank removes LVR restrictions for 12 months – Reserve Bank of New Zealand". www.rbnz.govt.nz. Retrieved 25 May 2020.

- "The Reserve Bank has undertaken a review of the loan to value ratio (LVR) restrictions and found they have been effective in improving financial stability but have 'an efficiency cost'". interest.co.nz. 22 May 2019. Retrieved 1 November 2019.

- "New Zealand passes ban on foreign homebuyers into law". Reuters. 15 August 2018. Retrieved 1 November 2019.

- Mark Lister (21 February 2017). "Three things that could burst bubble". New Zealand Herald.

- Hamish Rutherford (27 February 2017). "Net migration hits 71,000 as Kiwis turn their back on living overseas". Stuff.co.nz/Business Day.

- Isaac Davidson (10 August 2016). "Migrants not to blame for Auckland's house prices, study finds". New Zealand Herald.

- Joanna Wane (17 September 2017). "Running on empty: The 'ghost homes' in Auckland's housing crisis". Metro Magazine.

- Gibson, Anne (12 June 2016). "Rise of the ghost homes – More than 33,000 Auckland dwellings officially classified empty".

- "Bright-line test period extended| NZ LAW". nzlaw.co.nz. Retrieved 1 November 2019.

- "Tax matters : Beware the bright line property test". The New Zealand Herald. 10 September 2018. ISSN 1170-0777. Retrieved 1 November 2019.

- "Government announces end to state home selloff". Stuff. 20 December 2017. Retrieved 8 January 2020.

- "Information for property developers | KiwiBuild". www.kiwibuild.govt.nz. Retrieved 1 November 2019.

- admin (28 June 2018). "Kiwibuild visa replaced with new Kiwibuild skills shortage list". NZ Immigration Law. Retrieved 1 November 2019.

- "Doubts over KiwiBuild's affordability". Newshub. 25 February 2018. Retrieved 1 November 2019.

- "Labour's flagship policy: Where did KiwiBuild go wrong?". Newshub. 9 April 2019. Retrieved 1 November 2019.

- "PM takes housing off Phil Twyford in first major reshuffle". Stuff. 27 June 2019. Retrieved 1 November 2019.

- Jamie Morton (10 February 2021). "Government confirms it will scrap Resource Management Act, create three new acts". New Zealand Herald.

- "RMA to be scrapped, Environment Minister explains new three-law plan". Stuff. 10 February 2021.

- Jamie Morton (29 July 2020). "Govt-ordered review calls to scrap Resource Management Act". New Zealand Herald.

- Thomas Coughlan (29 July 2020). "Scrap and replace the RMA, official report to Government says". Stuff.

- Thomas Coughlan (16 August 2023). "Government passes RMA replacement bills, ending 30 years of RMA". New Zealand Herald.

- Matt Burrows (21 March 2021). "'What it'll take to halt New Zealand's housing crisis – and why LVR, RMA changes will do little to help first-home buyers". Newshub. Retrieved 1 April 2021.

- Sam Sachdeva (23 March 2021). "'No silver bullet', but Govt fires plenty at housing crisis". Newsroom. Retrieved 1 April 2021.

- Jeremy Couchman (25 March 2021). "Higher house price caps would have helped only a few hundred first home buyers". Newsroom. Retrieved 1 April 2021.

- Jenée Tibshraeny (23 March 2021). "Govt advised against changing interest deductibility rules; Meanwhile Treasury wanted a 20-year bright-line test and Inland Revenue didn't want a change to the status quo". Interest. Retrieved 1 April 2021.

- "National's backdown on bipartisan housing accord 'a massive flip-flop' - Sepuloni". RNZ News. 29 May 2023.

- "Future of Tax: Final Report". taxworkinggroup.govt.nz. Retrieved 1 November 2019.

- "Capital gains tax abandoned by Government". Stuff. 17 April 2019. Retrieved 1 November 2019.

- James Weir (5 June 2013). "OECD call for capital gains tax". BusinessDay.

- Tom Pullar-Strecker (28 May 2018). "Capital gains tax 'sensible' and fair for NZ, says OECD official". Stuff.

- Nicholas Pointon (12 March 2021). "Housing affordability: IMF recommends capital gains tax". RNZ News.

- Thomas Coughlan (12 March 2021). "Capital gains tax on the table to fix NZ's broken housing market, says IMF". Stuff.

- "Fiscal, Distributional and Efficiency Impacts of Land and Property Taxes". Motu Economic & Public Policy Research. 1 September 2009. Retrieved 19 December 2020.

- "Auckland University's Ryan Greenaway-McGrevy extols the virtues of a land tax & how one would hit both landbankers and wealthy foreigners buying NZ land". interest.co.nz. 4 September 2017. Retrieved 8 January 2020.

- "Why a land tax is the best tax reform". Newsroom. 22 March 2018. Retrieved 8 January 2020.

- OECD (2012). "Debt and Macroeconomic Stability" (PDF). OECD Economics Department Policy Note No 16. Retrieved 1 November 2019.

- Wallace Chapman (28 May 2017). "Steve Keen: The coming crash". RNZ.

- "NZ at 40% risk of housing bust – Goldman Sachs". RNZ News. 16 May 2017.

- Bernard Hickey (28 April 2014). "The problem of moral hazard in our 'Too Big To Fail' property market". Newsroom.co.nz.

- Bernard Hickey (1 March 2021). "New Zealand's economy is a housing market with bits tacked on". Stuff.

- Andy Fyers (7 December 2016). "Blowing Bubbles: Who loses the most when a housing bubble bursts". Stuff.co.nz/Business Day.

- Hargreaves, David (6 June 2021). "A crunch of bank lending figures over the past 20 years shows an ever increasing share of bank-borrowed money is going into houses rather than businesses or agriculture". interest.co.nz. Archived from the original on 26 August 2022. Retrieved 9 September 2023.