Unnatural selection

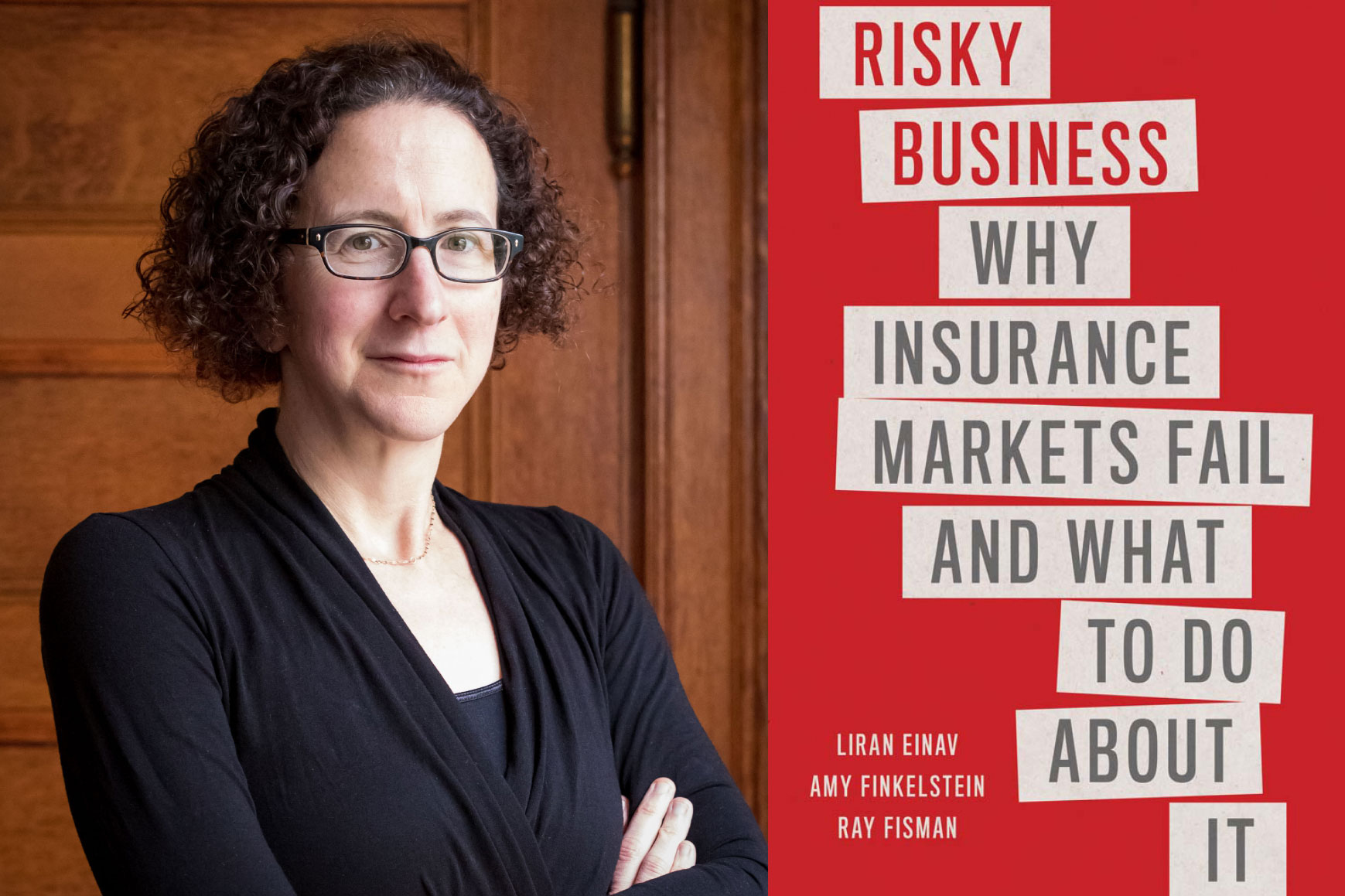

In a new book, “Risky Business,” Amy Finkelstein examines the core issue of the insurance industry: Who gets to be a customer?

Across the U.S., about three-quarters of people enrolled in Medicare Advantage plans — a form of private insurance following the rules of Medicare — receive free gym memberships. Why is this?

The answer, research has shown, is that it improves insurers’ client base: The promise of free workout time does not lure existing customers from the couch to the gym, but it does draw healthier-than-average new clients. For insurance firms, this matters. When their customers are healthier, insurers pay out fewer claims, and make higher profits.

“What you see in the data is these programs actually attract people who are healthier,” says MIT economist Amy Finkelstein, a scholar of insurance. “Things like mobility, or energy level, or pain are very hard for an insurer to observe about a potential customer. If you want customers who are in better physical shape, above and beyond what you can observe about them, finding people who want to go to a gym, who see that as appealing, is a very nice way to identify those new customers.”

In turn, the entire insurance industry revolves around a struggle over the kinds of customers it attracts. People want insurance in case something goes wrong. But insurers want customers who rarely need surgery or auto repairs or have their homes slide into the ocean. This makes insurance a distinctive industry.

After all, a supermarket chain or auto dealership is not overly concerned with who buys its products, as long as sales are sufficient. But for an insurance company, getting this issue right makes the business viable, while getting it wrong makes firms and markets fold. Attracting too many needy customers, from the insurer’s point of view, is the problem of “adverse selection” in the business

“Your insurer cares a great deal about which customers buy its products,” Finkelstein says. “Because the insurer’s profits depend not only on how much they sell, but whom they sell to.”

Finkelstein, the John and Jennie S. MacDonald Professor of Economics in MIT’s Department of Economics, has co-authored a new book on the subject, “Risky Business: Why Insurance Markets Fail and What to Do about It,” published today by Yale University Press. It is written with Liran Einav, a professor of economics at Stanford University, and Ray Fisman, a professor of economics at Boston University.

Everywhere we look, the issue of adverse selection

Finkelstein is a leading health insurance scholar and has often collaborated with Einav on research papers on that topic. However, “Risky Business” covers many insurance types — life, auto, dental, and more. In all these areas, companies go to great lengths to avoid adverse selection, which explains many frustrating or quirky features of insurance.

For instance: Why do health insurance companies have an “open enrollment” period lasting only a few weeks a year? Why is dental insurance “appallingly inadequate,” as the authors write in the book? If you sign up for auto or life insurance, why is there a waiting period before your policy takes effect? Why would auto insurers care about your GPA?

In every case, the answer involves selection. Open enrollment periods exist so that people do not wait until they have a specific medical diagnosis before choosing their insurance. When it comes to dental insurance, studies show that people are highly aware of their dental needs — and try to wait until they need more dental care before upgrading their plan.

This might seem exactly how insurance should work for consumers: Sign up for what you need, get reimbursed. However, the purpose of insurance as a system is to provide a buffer against the vagaries of fate. If people wait until things go awry to sign up for insurance, it can produce a vicious spiral. When enough consumers need help and payouts increase, premiums rise and insurance can become unaffordable. Companies and industry sectors can collapse in the meantime.

“One of the biggest problems with adverse selection is it can make a market disappear entirely,” Finkelstein says.

This is also why insurance waiting periods exist — often two years for life insurance, or a week for auto insurance. As the book recounts, when Finkelstein’s husband — MIT economist Ben Olken — was in graduate school, his car broke down. Waiting on the shoulder of the road for AAA to arrive, he called to upgrade his auto insurance so it would cover the long-distance tow he now wanted. To his delight, Olken was told he could increase his coverage. To his dismay, he was then informed the new policy would not start for a week. Blame adverse selection.

“We’re trying to show that there’s a common theme behind a lot of things out there in the world,” Finkelstein says.

Indeed, auto insurers want to know the academic records of prospective clients because, for whatever reason, people with more success in school file fewer auto insurance claims. And from time to time, firms figure out new methods — like gym-membership offers — to build up their base of consumers who only infrequently need insurance.

As “Risky Business” also shows, it has taken a while for insurers to reach this point. In the late 17th century, Edmond Halley, better known for the comet that bears his name, used German census records to develop the first systematic method for pricing annuities, a type of insurance that guarantees an annual payout until death. It was not a viable system though, precisely because Halley had not considered adverse selection.

Secret knowledge

For all that insurers do know about people in the age of big data, the industry still does not have everything figured out. People who acquire life insurance, research has shown, are more likely to die younger. But it is unclear why, based on available health metrics.

“We still don’t really know what it is that people know but their life insurers can’t figure out,” Finkelstein says.

As the authors detail in the book, adverse selection leaves policymakers in a bind. Making health insurance the same price for everyone, even for those with observable problems, can seem fair and just. But the numbers may not add up for insurers, as shown by the collapse of state-backed health insurance exchanges in New Jersey and New York that required that all customers be charged the same price.

“In one sense it was fairer, in that nobody was being treated differently, but everybody was suffering from a lack of insurance,” Finkelstein observes. “We need to understand those tradeoffs and make more informed decisions.”

The Affordable Care Act, famously, has addressed adverse selection by mandating that everyone — even the healthy — obtain health insurance, while providing subsidies for people to sign up. That approach has been the subject of much debate, but it does acknowledge the central tension of insurance.

“Sometimes even getting the policy right doesn’t mean making the world perfect, but deciding how to balance different types of problems,” Finkelstein says.

Experts have praised “Risky Business” and its approach to explaining the insurance markets. Nobel laureate economist George Akerlof PhD ’66 says, “The very human cat-and-mouse stories that animate ‘ Risky Business’ are not only great fun; they also subtly reveal the basis of a great deal of economics.”

For her part, Finkelstein hopes the book will interest a broad audience of readers who, whether content or frustrated with their insurance, will at least take satisfaction in grasping why the whole industry has its current form and practices.

“We see our role as helping people to understand the world around them a little better,” she says.

Reprinted with permission of MIT News